30 Aug GAME CHANGER! – ARE YOU IN?

Dr. Sherry McCoy PhD

is a freelance writer & actor for the Stop Senior Scams Acting Program (SSSAP) in Los Angeles. Follow SSSAP on Facebook . For more info re: SSSAP, contact Adrienne Omansky at SSSAP4U@gmail.com. Questions for the writer should be directed to “Dear Sherry” at Not Born Yesterday! P.O. Box 722, Brea, CA 92822 or nbynews@juno.com.

GAME CHANGER! – ARE YOU IN?

Dr. Sherry McCoy, PhD – Stop Senior Scams ℠ Acting Program

Greetings All! It’s September 2022. Summer is winding down and making way for fall, which officially starts on September 22 — the Autumn Equinox. As we prepare for a shift in the seasons, now seems like the perfect time to also consider making a needed shift in our collective consciousness about crimes of financial fraud. Recently, the AARP Fraud Watch Network, along with FINRA Investor Education Foundation and Heart + Mind Strategies, embarked on a research project to document the systemic tendency in our society to ‘blame the victims’ of financial fraud, rather than the criminals who perpetrate such crimes. In June of 2022, AARP et al, published a report based on the findings of their research project called “BLAME AND SHAME IN THE CONTEXT OF FINANCIAL FRAUD: A Movement to Change our Societal Response to a Rampant and Growing Crime.” There is not enough space or time to elaborate here on all the findings of this ground-breaking study. So, I will highlight only a few of what I consider to be the most salient and significant takeaways from my reading of the report. Nonetheless, I encourage everyone to take the time to read the full and comprehensive 24-page report. It is an eye-opener and a game-changer. The good news is it likely will challenge you to re-think the way you typically view criminal perpetrators and victims of financial fraud. You can read the report here at — https://www.aarp.org/content/dam/aarp/money/scams_fraud/2022/07/aarp-fraud-victim-blaming-report-06-07-22.pdf

STUDY OVERVIEW

Why did AARP et al decide to invest in a study like this? The short answer to that question has to do with the awareness that the societal practice of ‘blaming the victims’ of financial fraud rather than the criminals who create and execute these crimes, subverts and thwarts justice. And most pointedly, when justice is thwarted, no one wins.

The sad truth is we live in a ‘victim-blaming’ culture, where responsibility is assigned to the “targets” of the crime, rather than the “perpetrators,” i.e., criminals. This shame/blame game is often expressed in everyday life. For example, if you are the victim of financial fraud and are shamed / blamed by friends and family, you are unlikely to want to report the crime. If you don’t report the crime, law enforcement doesn’t know the crime occurred and therefore can’t investigate the matter. Prosecutors can’t indict lawbreakers for the crime because it wasn’t reported and investigated. Policymakers can’t take meaningful action to counter the multi-billion-dollar fraud industry because … the vast majority of financial fraud crimes are not reported. A domino effect.

This societal misdirection of blame in matters of financial fraud is a big part of what keeps financial fraud criminals in business. It’s time we made a cultural shift to move away from the shame/blame game. If we change the collective narrative, it will go a long way toward putting scammers out of business! One of the best ways we can do that is to stop blaming the victims of financial fraud, and instead support and encourage them to report the crimes to appropriate authorities. This act alone is empowering. In addition, when we stop blaming victims and instead re-direct our attention toward the wrongdoers, we send a strong message to criminals that we are no longer giving them an easy out. Instead, we put them on notice that they will be held accountable for their nefarious actions.

LANGUAGE MATTERS

One of the most interesting discoveries of the AARP et al study was that the language we use to talk about financial fraud victims and criminal perpetrators matters. For example, in discussing how language in the media can perpetuate a blame the victim mentality, AARP et al (page 10) had this to say:

While subtle victim-blaming language in the body of a story may be used, more often they tend to portray and perceive victims neutrally, or at worst, overly focus on the victim as a number or on the dollar amount of the crime. But headlines almost always focus on the victim being “duped” or “bilked”, while property or violent crime headlines focus on the crime and the criminal. Ultimately, however, whether advertently or inadvertently, media and their accompanying stories tend to dehumanize the victim, which can create a sense of detachment.

The entertainment industry portrays the scammer as a keen and stealthy hero (e.g., “Catch Me If You Can”, “Wolf of Wall Street”, “Ocean’s 11”, etc.), a reality that no doubt facilitates an unequal victim-to-criminal dynamic and worked to downplay the victim reality.

Each of these behaviors … perpetuate blaming language and a culture that perceives victims as inferior.

SOLUTIONS

The good news is this: The AARP et al study revealed a number of opportunities or strategies that we can take to shift our collective consciousness away from the culture of “victim-blaming” and toward greater justice for all. Below is a brief summary of those strategies. (See AARP et al, pages 13-15)

Addressing Victim Shame – Increase victim outreach to emphasize they are not alone; that they aren’t at fault for the crime; that the fault lies with the perpetrators. Increase personalized and emotional storytelling of people who have had their money stolen.

Increasing Focus on the Perpetrator and the Crime Itself – Increase focus on perpetrators of financial fraud in the media, revealing the “ugly” face of scam rings, their nefarious and manipulating tactics, etc.

Increasing the Priority of Fighting Financial Fraud at the Institutional Level – “Decreasing victim shame (and their lack of faith in the system’s ability to help them) can lead to an increase in reporting of cases of fraud. This will demonstrate the impact and seriousness of financial fraud at macro-levels to the general population and help prioritize action across financial services, legal, criminal justice, and government institutions.”

Use Alternative Language to Describe Victims, Perpetrators, and the Crime Itself – Use language to describe the criminal activity. For example – “It’s not that the victim was duped. It’s that the criminal stole the victim’s money.” Use language to “capture the accuracy of the criminal perpetrator” as opposed to generic terms like ‘scammer’ or ‘fraudster’ which often downplays the gravity of the crime. Use language that separates a person’s identity from their circumstances. Use language that emphasizes the depth/breadth of a crime, like “financial attack” or “financial assault” and helps illustrate the human impact of financial fraud.

Humanizing the Emotional Impact of Fraud – The goal here is to raise awareness of the emotional impact of fraud on victims and society at large. “Illuminating the personal, emotional impact these attacks have on victims can bring to life the victim’s reality in a way that resonates far more deeply and meaningfully with people. This can serve to transfer blame away from victims.”

Be Empowered. Find Your Voice. Speak Out About Fraud!

WHERE TO REPORT SCAMS

Federal Trade Commission at 877-382-4357 or online at https://www.ftccomplaintassistant.gov/#crnt&panel1-1.

For questions about Medicare fraud / abuse, contact Senior Medicare Patrol (SMP*) at 1-855-613-7080.

U.S. Senate Special Committee on Aging’s Fraud Hotline at 1-855-303-9470.

RECENT AND UPCOMING SSSAP PERFORMANCES

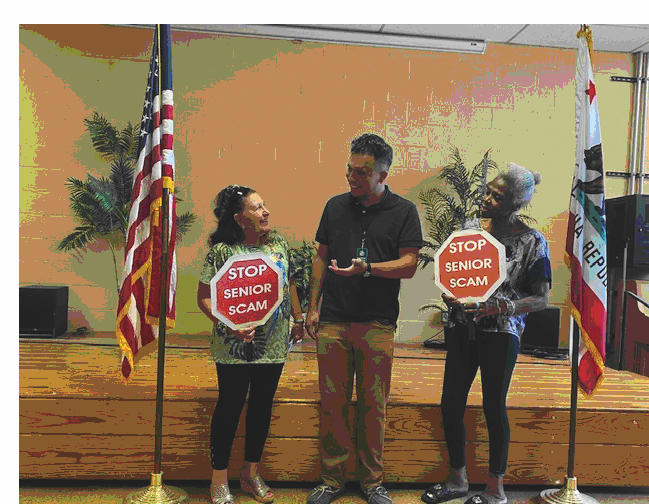

The Stop Senior Scams Acting Program performed in person at Claude Pepper Senior Center on Friday, August 19th. The performance was a great success!

From Left to Right: Irma Derrick, SSSAP Actor; Anthony Montiel, Director of Claude Pepper Senior Center; DeBorah Gittens-Hubbard, Program Attendee.

SAVE THE DATE!

SSSAP will perform free of charge at the North Hollywood Recreation Center on Saturday, October 22, at 11am. More details to follow in the October issue of NOT BORN YESTERDAY!

SSSAP continues virtual programs, and we are now booking in-person programs for 2022. Please contact Adrienne Omansky at SSSAP4U@gmail.com for more info, or if your organization would like to host our program.

STOP SENIOR SCAMS℠ ACTING PROGRAM on YOUTUBE

We are proud to announce a new SSSAP video on Senior Fraud Awareness, sponsored by the Ventura County Area Agency on Aging (VCAAA). Click this link to watch it! https://www.youtube.com/watch?v=nVjSdUaoY9E

Please go to the SSSAP YouTube Channel https://www.youtube.com/channel/UCjFjb-WPPr8KAXq1dlu1EvA to see our new videos. If you subscribe (free of charge), you will be notified when new videos are released. Together we can Stop Senior Scams! Here are links to two recent videos: “The Top Senior Scams with SSSAP” https://www.youtube.com/watch?v=cp097g7hTUg, and “Robocalls, Mail Fraud and Merlin with SSSAP” https://www.youtube.com/watch?v=dA3noym9JPo&t=186s.

Remember – You may be a target, but you don’t have to be a victim!

Dr. Sherry McCoy, PhD is a freelance writer & actor for the Stop Senior Scams ℠ Acting Program (SSSAP) in Los Angeles. Follow SSSAP on Facebook at https://www.facebook.com/SSSAP2016/?fref=ts. For more info re: SSSAP, contact Adrienne Omansky at SSSAP4U@gmail.com. Questions for the writer should be directed to “Dear Sherry” at Not Born Yesterday! P.O. Box 722, Brea, CA 92822 or nbynews@juno.com.

Sorry, the comment form is closed at this time.